who do i call about a state tax levy

Liens are filed with the county Register of Deeds andor the Secretary of State as security that a debt will be paid from proceeds when a taxpayer sells real or personal property. An IRS tax levy is a legal seizure of your property to compensate for your tax.

Levy E News Aarp Income Tax Aide Update Spring Art And Dance Classes And More

For more information you may call the.

. The State Income Tax Levy Program SITLP is an automated levy program administered by the IRS that uses state tax refunds as the levy source. The Minnesota Department of Revenue may issue a wage levy to collect tax debt or debt we collect for another agency. The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for.

It is different from a lien while a lien makes a claim to your assets. 25 of the gross wages are withheld for state tax and outside agency assessment. A levy against the wages of an individual for assessments andor tax liens due the SCDOR.

A tax levy is a process that the IRS and local governments use to collect the tax money that theyre owed. For the status of your state tax. A tax levy is a legal seizure of your property by the IRS or state taxation authorities.

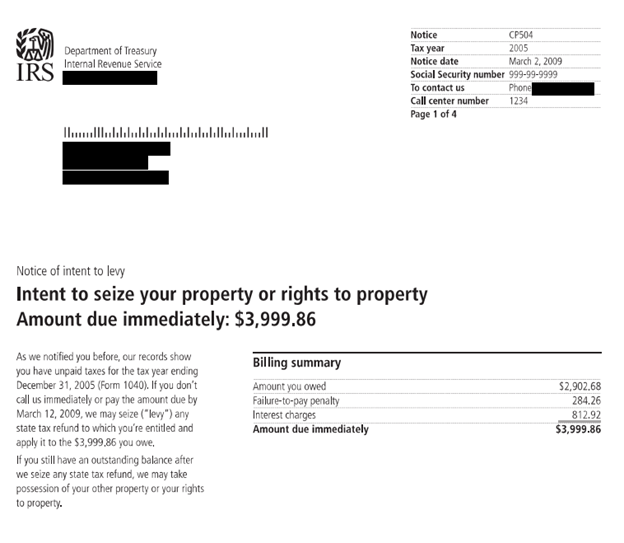

Prior to the levy the IRS will have issued a notice of intent to levy and notice of your right to a hearing about the levy. It can garnish wages take money in your bank or other financial account seize and sell your. A tax levy itself is a legal means of seizing taxpayer assets in lieu of previous taxes owed.

Typically a state tax levy only comes after back taxes have fallen far into arrears and the state has not entered into an. A property tax levy is the right to seize an asset as a substitute for. State tax levies can come in the form of a wage garnishment bank account seizures and property seizure.

A state tax levy is a legal seizure of property by a state tax authority. A state tax levy is a collection method that tax authorities use. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets.

A tax levy is not the. Tax levies are collection methods used by the IRS where they can legally seize your assets to cover back taxes. When we send a wage levy notice to.

Through a tax levy you may have money taken from your bank. In addition your citymunicipal agency will issue a notice. Wage Levy for Individuals.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. A state tax levy is the states way of forcibly seizing your assets.

Business Office Understanding New York States Tax Levy Cap

Tax Levy Understanding The Tax Levy A 15 Minute Guide

How Do State And Local Sales Taxes Work Tax Policy Center

What Is A State Tax Levy State Income Tax Levy Program

What Is A Levy How To Get It Released Tax Debt Advisors

Avoiding Federal Tax Levy What Is A Levy Ohio Tax Lawyer

States Should Be Allowed To Levy Sales Tax On Internet Access

Irs Levy Tax Matters Solutions Llc

What Is A Tax Lien Credit Karma

Orange City S Total Property Tax Levy Rate Ranks 551st In The State Orange City

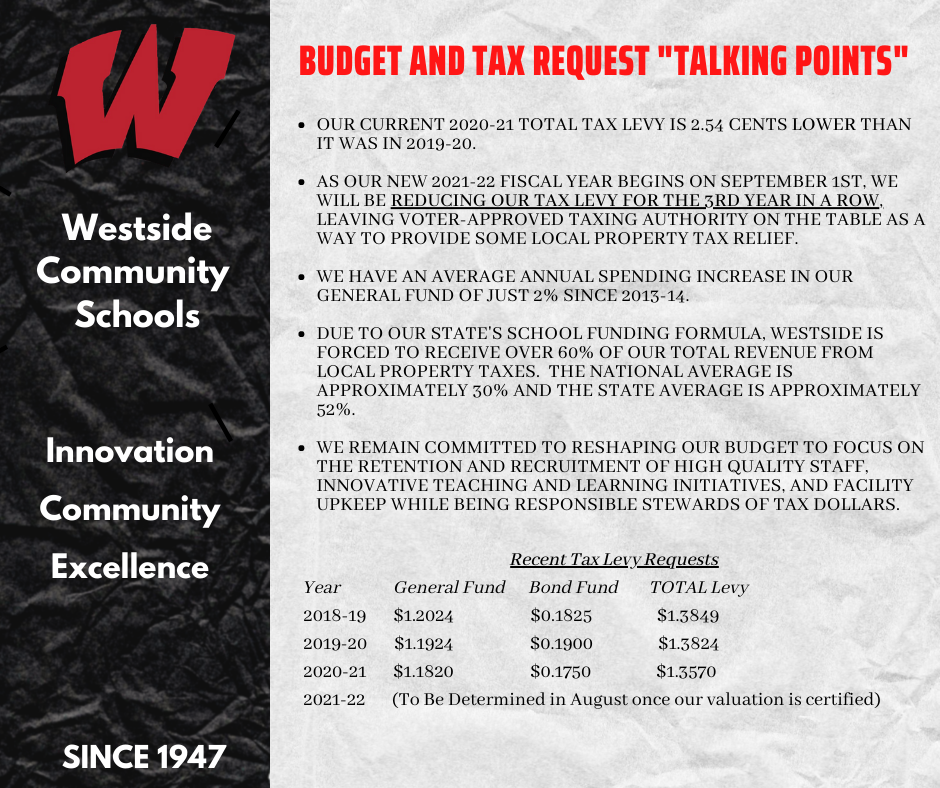

June 25 2021 District Reduces Tax Levy For 3rd Consecutive Year

Can The Irs Levy Or Garnish My Bank Accounts Tax Attorney Newport Beach Ca Orange County Dwl Tax Law Daniel Layton

Irs Tax Debt Relief Help Resolve Irs Tax Levy Problems Victory Tax Solutions

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

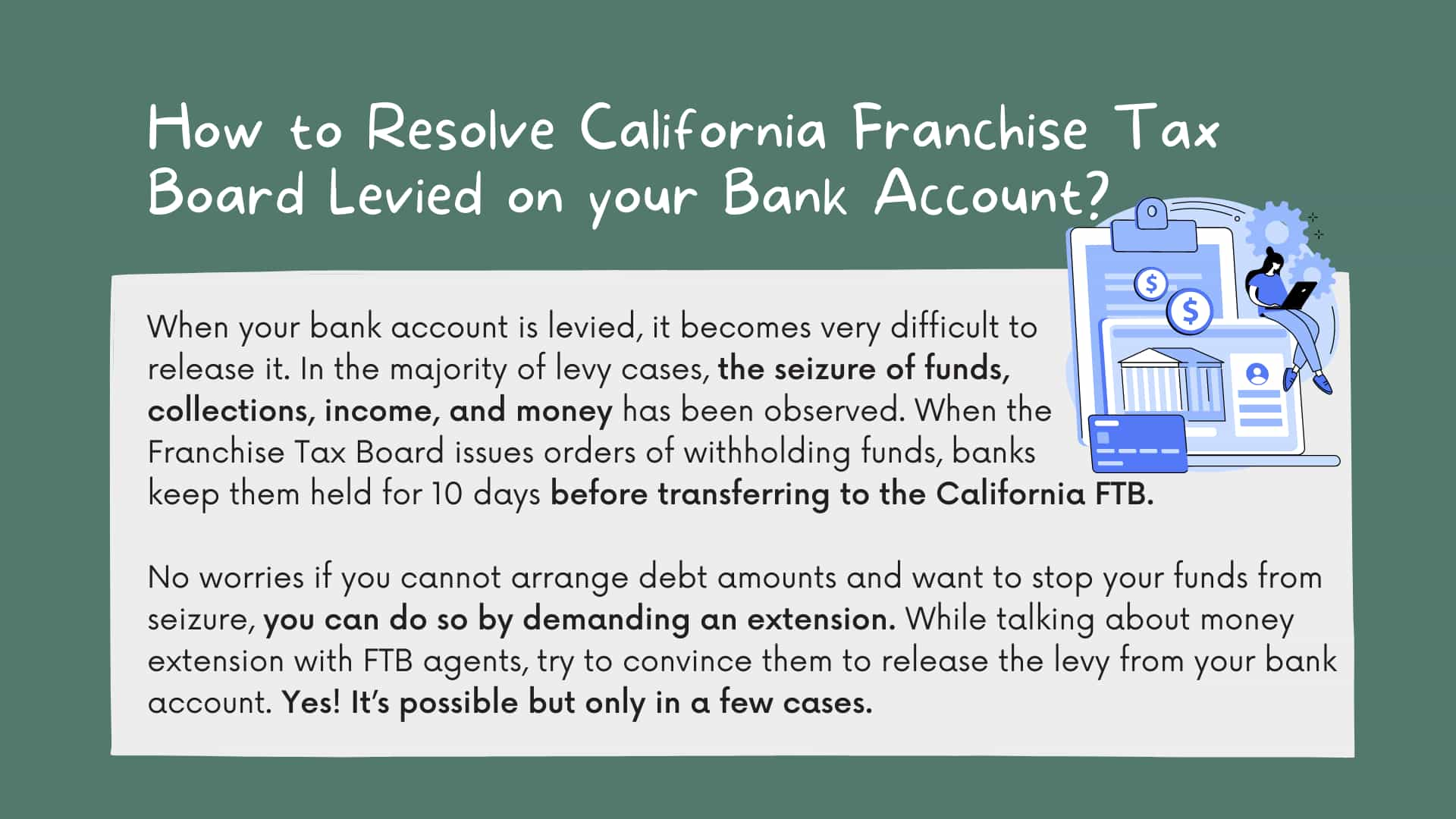

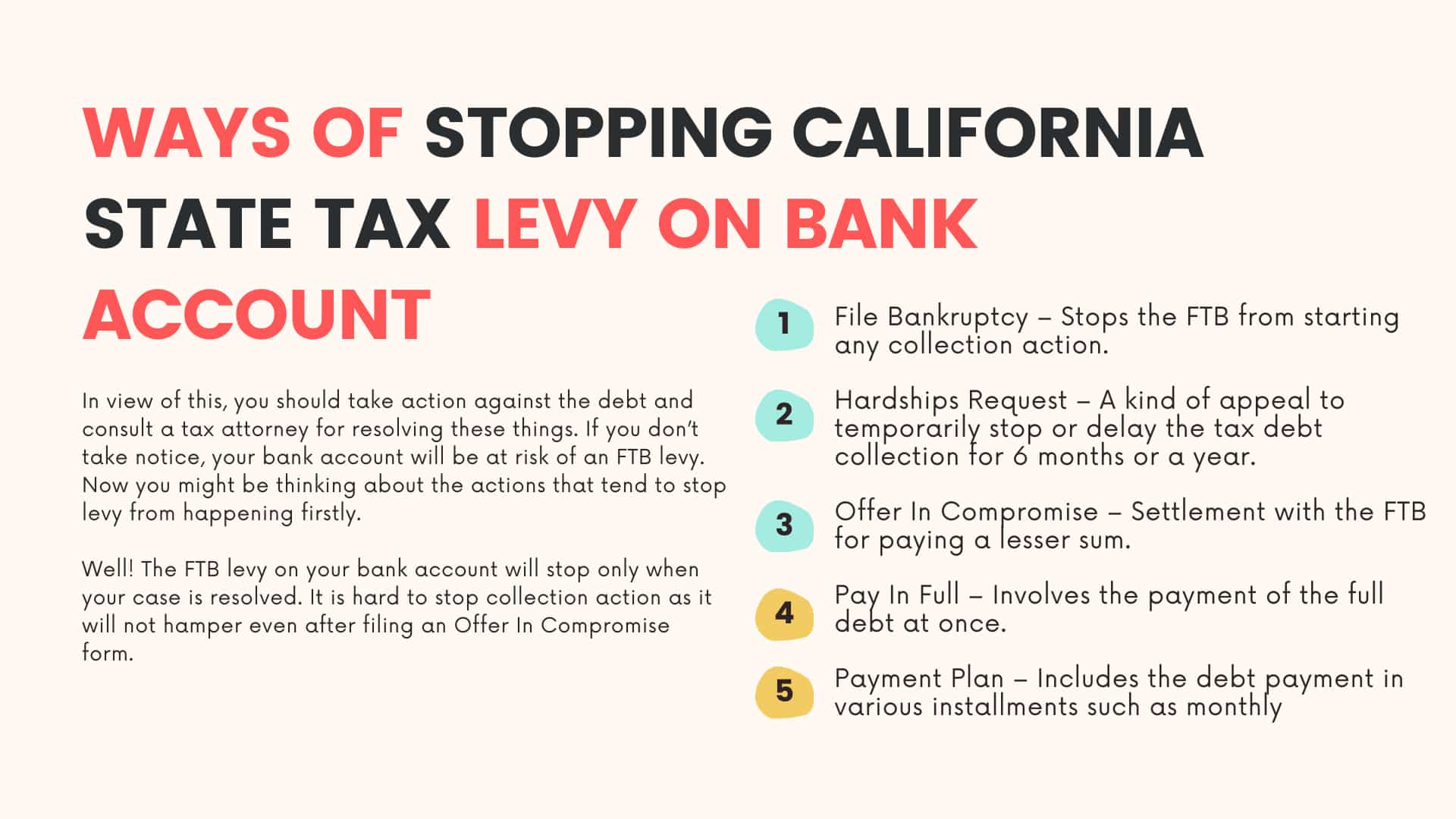

3 Proven Ways To Stop California State Tax Levy On Bank Account

Irs Tax Notices Explained Landmark Tax Group

Tax Levy What It Is And How To Stop One Nerdwallet

Who Do I Call About An Irs Tax Levy

3 Proven Ways To Stop California State Tax Levy On Bank Account